Over the past few years, the same narrative has been repeated over and over again: the market is tough, demand is slowing, margins are tightening, and competition is intensifying. To some extent, this is true. But too often, it also becomes a convenient explanation — one that is used to justify commercial results that actually have a far more uncomfortable root cause.

It’s not the market.

It’s the conversion of the demand that already exists.

Most companies in the automotive aftermarket have a very solid understanding of what they sell. Revenue, margins, turnover, profitability by customer or product family. Today’s systems are very effective at analysing the past and explaining it in great detail.

The problem is not sales. It is demand conversion.

The real gap appears when trying to answer a much more uncomfortable question: What share of real demand is not being converted into sales?

Every day, enquiries, searches and requests enter the organisation without ever turning into an invoice line. Not because customers do not want to buy, but because the system fails to respond adequately at that specific moment. And when that happens, the opportunity simply disappears.

No trace remains.

No alert is triggered.

No analysis follows.

Sales are lost without anyone noticing.

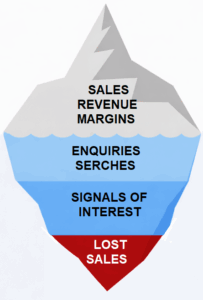

Level 1 – Sales, revenue, margins: Sales already completed and recorded.

Level 2 – Enquiries, searches: Explicit demand that does not always convert into sales.

Level 3 – Signals of interest: Early indicators of commercial interest not recorded as enquiries or sales.

Level 4 – Lost sales: Real demand that did not turn into revenue and is not reflected in existing systems.

The causes are well known to anyone operating in the sector: Incomplete or incorrect equivalences, products outside the range, lack of stock availability at the moment of enquiry, non-competitive pricing.

These situations are, to some extent, unavoidable. But they have a direct impact on demand conversion.

The problem is not that these situations exist.

The problem is that most systems neither detect nor quantify them.

When a sale does not happen, it does not appear in any report. It simply never exists. And what cannot be seen cannot be managed.

The P&L (profit & losses) comes too late to explain lost sales.

Commercial decisions are often made by looking only at revenue, margins and results. But the P&L only shows what has already happened — not what could have happened.

All demand that failed to convert into sales remains outside the analysis, and therefore outside decision-making.

The real battleground is not reporting or traditional Business Intelligence. It lies earlier, at the exact point where a specific demand either becomes revenue — or does not.

If you do not know which demand you are losing, you are making decisions with a partial view of the business.

In a mature market, under constant pressure on prices and margins, growth no longer depends on generating more demand, but on making better use of the demand you already have. This is where one of the most overlooked levers in the sector comes into play: demand conversion.

Improving demand conversion is an operational and actionable lever, not a theoretical or abstract concept. It means identifying where sales are being lost, prioritising actions based on real economic impact, and correcting concrete inefficiencies in equivalences, range, stock, pricing or equivalences.

But to do that, one prerequisite is essential: visibility into real demand and its leakages.

NEO system operates in this pre-P&L layer, where it is decided which share of demand turns into revenue. It is not a reporting tool or another BI platform. It analyses real demand, identifies lost sales, explains the causes and proposes concrete actions to avoid them.

Not to sell more “in theory”. But to stop losing real sales that currently go unnoticed.

The market is demanding, yes. But in many cases, the main problem is not external.

It’s not the market.

It’s your demand conversion.

By Joan Cabós

CEO & founder